When I first thought about setting up for my CCW the concept of CCW insurance did not cross my mind at all initially.

Then when I finally realized I needed an insurance policy for my CCW after learning about the benefits I initially assumed that any CCW insurance provider was just as good as any other.

I was wrong.

Let’s dive into just how wrong I was and why USCCA insurance has my personal stamp of approval moving forward.

Must-Have

|

|

Learn More |

SKIP AHEAD

What is Concealed Carry Insurance and Why Should I Bother?

CCW insurance is an insurance policy specifically designed for those who are carrying a concealed weapon in the event that they are actually required to utilize it in self-defense or in an altercation and are enduring costs incurred due to insurance and the legal system.

Even if you are justified in defending yourself you may still find yourself contending with challenges such as bail money, civil or criminal defense costs, and much more and in these instances CCW insurance suddenly seems terribly relevant. I know that I felt prepared for an altercation but I suppose I was not thinking about the aftermath of an altercation.

As I looked further into it and thought more on the subject one of my favorite old sayings came to mind that prompted me to move forward with acquiring a concealed weapon insurance policy.

“I’d rather have it and not need it than need it and not have it.”

Concealed Carry Insurance Purchasing Guide

USCCA was not my first choice because initially I thought that any CCW insurance would do the trick.

While having any CCW insurance coverage is better than having none, I could not help but learn overtime that there are distinct differences in providers and the value that they each offered. Once I invested the effort to better educate myself on the topic I realized that there were still some serious factors I had not considered.

Let me break down a few parameters that stood out to me as I reassessed my own coverage situation:

Range of Coverage

Have you ever opted for the cheapest car insurance and found out the hard way that it did not protect you in a specific situation that you were in? This same concept applies to your CCW Insurance. For instance, I’ve learned that many other CCW insurance providers are very limited in the type of weapons that they will cover. USCCA will cover other legal weapons such as bats, clubs, fists, blades, and more. Also worth reviewing whether or not your policy extends beyond state lines or protects against firearm theft. Taking the time to understand just what you’re paying for is something any good prepper should be doing anyway.

Straightforward Language

My other half and I have years of experience working alongside insurance providers in the roofing industry and have learned first-hand just how slippery language can be when it comes to insurance providers. One of the things I appreciate most about USCCA is how clear the price breakdowns are how straightforward the coverage seems to be. I just am not getting the sense that anyone is trying to pull one over on me.

Fair Pricing to Value Ratio

When I finally got to breaking down the math of how much various memberships are for USCCA oh, how much is provided per plan, and what the potential risks are of not caring the CCW insurance I came to the conclusion that all of the membership plans with USCCA are more than fairly priced and offer serious value. My experience with the gold membership level has been very smooth and I’m giving thought to upgrading to the platinum membership level.

Additional Resources

The sting of the monthly CCW insurance charge does not feel as terrible if I feel like I’m getting additional value beyond the coverage of the policy. Many providers grant access to training materials, educational content, discounts on gear, and so much more with membership and it really helps me better about the regular expense. It is also worth exploring just what additional content or value is provided and whether or not you personally would enjoy it or benefit from it. Some of the legal resources available through CCW insurance providers are very useful.

USCCA Review: Pricing Breakdown

As I mentioned before, I’m fond of keeping things clean and simple so that they may be easily understood with little room for misinterpretation.

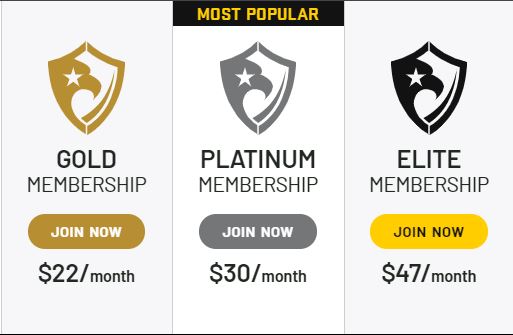

The USCCA price breakdown keeps it clean and simple in a way that I enjoy and makes me feel comfortable moving forward with. There are three different primary membership levels that gradually increase in cost per month, services provided, and total insured amounts. Each membership also grants access to the monthly letter, educational content, and more.

The three memberships are broken down as follows:

Gold

- First-tier of membership.

- Cost $22 per month or $247 per year

- Insured up to $600,000 in self-defense Shield protection.

- Up to $500,000 for civil suit defense and damages.

- Up to $100,000 criminal defense protection upfront attorney retainer.

- $5,000 to $50,000 and upfront bail bond funding. Worth noting that there are circumstance Pacific stipulations regarding this topic.

- Up to $350 per day for compensation while in civil court.

- Up to $3,000 for personal hardship coverage.

- Up to $3,000 for psychological support.

Platinum

- Second-tier of membership.

- Cost $30 per month or $347 per year.

- Insured up to $1,150,000 in self defense Shield protection.

- Up to $1000000 in civil suit defense and damages.

- Up to $150,000 and criminal defense protection upfront attorney retainer.

- $25,000 to $250,000 an upfront bail bond funding.

- Up to $500 per day for compensation while in civil court.

- Up to $4,000 in personal hardship coverage.

- Up to $4,000 in psychological support.

Elite

- Third-tier of membership.

- Cost $47 per month or $497 per year.

- Ensure for up to 2250000 dollars in self-defense Shield protection.

- Up to $2000000 in civil suit defense in Damages.

- Up to $250,000 in criminal defense protection upfront attorney retainer.

- 50000 to $500,000 and upfront bail bonding money.

- Up to $750 a day for compensation while in civil court.

- Up to $6,000 for personal hardship coverage.

- Up to $6,000 psychological support.

If you’re unsure which membership level is ideal for you I would think to either to start with the basic Gold level and learn more from there or have a conversation with a representative from USCCA and dive a little deeper to determine which selection is best for you.

Must-Have

|

|

Learn More |

Pros vs Cons for using USCCA

Creating a list of pros and cons is another tried-and-true tactic that I’ve used many times when trying to decide a course of action and it seems useful here as well when reviewing this CCW provider. I honestly struggled a bit to come up with some cons to using this service provider.

Here is a list of my pros and cons for using USCCA:

Pros:

- Pricing is more than fair.

- Plenty of training and educational materials available with memberships.

- Clear and direct pricing models.

- Access to an experienced knowledgeable community and network of USCCA certified trainers.

- 100% american-based company.

- Variety of discounts available to members.

- Regular updates on changes to gun related laws are useful for keeping up to speed.

Cons:

- There’s no denying that CCW insurance is an expense that you are paying for monthly without use until it is actually needed. I understand that when it is needed it is incredibly valuable but there is that emotional reaction of spending money each month on something you are not physically seeing.

- The amount of emails and advertisements that I’ve been targeted with since joining is noticeable. This can be rectified to a degree via unsubscribing from the email list.

- USCCA policy coverage is not available in all states across the US. Washington, New Jersey, and New York currently are not able to access USCCA coverage.

CCW Insurance FAQs

Q: What is covered under a CCW insurance policy?

A: Just exactly what is covered under a CCW insurance policy and to what amounts will vary greatly by provider and membership level. Ideally a CCW insurance policy will provide coverage for court costs, medical costs, lost income replacement, mental health costs, and more. Even if you are in the right and defending yourself there are still many costs that can suddenly accrue in the event of a hostile or emergency situation. Just like medical bills, we often think that we don’t need to be prepared for the worst case scenario until we experience one.

Q: Does the Coverage Include Bail Bonds?

A: When looking over various policies I’ve learned over the years that it’s not always what’s listed that matters but what might be missing from the list that makes all the difference. There are CCW insurance policies that give decent coverage for court costs and medical bills but might leave you hanging out to dry when it comes to the bail bond. My thought is to make a point to look for mention of bail bond coverage when reviewing possible CCW insurance provider options.

Q: What are the Policy Caps?

A: A policy cap means the financial point where insurance providers stop covering you. Say you have legal fees up to $5,000 but your policy cap for this circumstance is $4,000. This would leave you financially responsible for the remaining $1,000 in this instance. I’ve had countless experiences with insurance providers being subtly difficult with policy language so I recommend making a serious point to clarify policy caps when selecting your own CCW insurance policy.

Q: What Additional Value Comes with CCW Insurance?

A: Here’s another one that varies from company to company but these days I’m starting to observe more and more companies working hard to give additional training and educational content to sweeten the deal, so to speak. You can expect many of these CCW providers to offer discounts on gear with partnered companies, legal resources, content focused on gun safety, access to firearm focused forums and communities, updates on expos, and so much more. Seems to me like they’re racing to stand out from one another and we the consumers benefit from this contest of theirs.

Comparisons with Other Insurance Providers

We have head to head comparitive reviews with other providers. Check them out:

Verdict

I hope you found my personal USCCA review helpful. I understand that it’s hard to become excited about purchasing insurance but the amount of value and coverage packed in with each USCCA policy, the amount of educational and training content, and the fair pricing model leaves me with less of a questionable taste in my mouth than your average insurance policy purchase.

When reviewing USCCA as an option I never felt pressured to move forward, it’s just laid out plainly and you can choose to move forward or not. On a personal note, I do appreciate opportunities to support American companies and that does factor into my decision.

Again, CCW insurance is an example of “I’d rather have it and not need than need it and not have it” and the USCCA stands out to me as the best provider of CCW coverage for the reasons listed above. Seems to me like they are trying to create additional value to give the members so you really feel like you’re more than your money’s worth. I mean, they currently have a contest going to win a chance to train with Tim Kennedy. How many insurance providers put that kind of opportunity on the table? All in all, anyone who asks me for advice about CCW insurance will be guided toward the USCCA as I am very pleased with my current Gold membership level and might even bump up a level down the line here to the Platinum membership level.

Must-Have

|

|

Learn More |